Has United Hampshire US REIT Done Well In FY2022?

It's been a while since I wrote my initial investment thesis on UHREIT, and I think it's about time that I reviewed their recent FY2022 performance and see if it still falls in line with my original idea, albeit I do admit that I'm quite late to the party. Nevertheless, let us delve deep and see how did UHREIT perform!

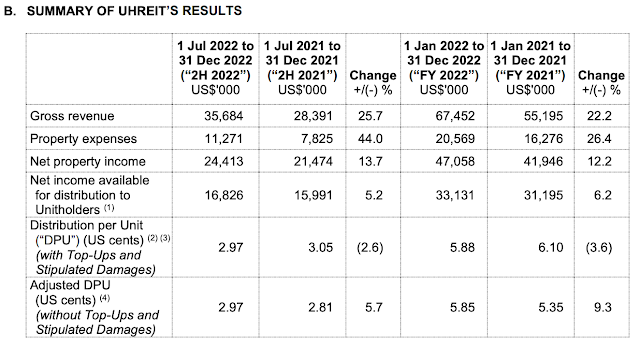

Brief Overview of FY2022 Income Sheet:

For simplicity's sake, we will be comparing the financial performance of the REIT on a YoY basis. At a glance, it seems like property expenses have outpaced gross revenue percentage-wise with a 26.4% increase as opposed to 22.2%. Nevertheless, Net Property Income still increased a significant 12.2%, with adjusted distribution per unit (DPU) increasing from 5.35 US cents to 5.85 US cents. You may be wondering why is there a section regarding DPU with Top-Ups and Stipulated Damages. This is due to the absence of income support for UHREIT's Self Storage properties, coupled with the absence of compensation regarding "damages" to one of its properties, Perth Amboy Self-Storage, due to a delay in construction completion.

Additionally, the reason why gross revenue and property expenses have seemingly ballooned so high is due to the new inclusion of Upland Square Shopping Centre.

Net assets inched up from $419 Million USD to $428 Million USD, with NAV per Unit remaining stagnant at 0.75 US Cents due to an increase in the number of units issued arising from management fees and SCRIP dividends.

One may also have noticed the declaration of an increase in the valuation of UHREIT's properties, which is in stark contrast to the recent Manulife REIT's sharp asset devaluation.

Of course, we should examine this claim a bit more in-depth before jumping for joy at this reassuring news.

Notably, there has been a decrease in valuation for Hudson Valley Plaza, Fairhaven Plaza, Wallington Shoprite, Wallkill Price Chopper, BJ's Quincy, Arundel Plaza Lawnside Commons, Colonial Square, and Penrose Plaza. Instead, these decreases were more or less offset by the relatively high increase in Self-Storage property valuations. It is understandable that Wallington Shoprite has experienced a decrease in valuation due to the fact that only approximately 17 more years are left for its lease. Doing some brief research, I am unable to find any specific reason for the decrease in valuations for the shopping centres and hence will assume that it is simply due to increasing interest rates depressing the property market.

You may be wondering to yourself why Millburn Self-Storage recorded such a high increase in valuation as compared to Carteret Self Storage... Well, we can see that the average quarterly net rental rate of both properties has increased and been maintained at a similar rate/level. So why is there such a large discrepancy?

My answer to that was that Millburn Self-Storage was simply undervalued previously. Both self-storage properties are located in New Jersey, but Millburn Self-Storage has a much higher Net Leasable Area (NLA) of 81K Square Feet as compared to Carteret's 74K Square Feet. If we incorporate a premium in Millburn's valuation due to the higher occupancy rate and price per square foot for rental, we can come to the conclusion that the increase in property valuation is most likely not inflated, which means it should not decrease drastically suddenly due to a correction.

In terms of debt profile, UHREIT has admittedly grown slightly weaker.

Although Gearing Ratio has slightly decreased from approximately 43% to 41.8%, Interest Coverage Ratio has slightly worsened, no thanks to the average interest rate of current loans being approximately 3.88%. Although 81.4% is fixed, the remaining 19% still has room to increase, which might lead to an average interest rate of 4%, drastically decreasing ICR. In my opinion, this is creeping up to dangerous levels, which I dislike.

Interestingly, I have more or less predicted the overall interest rate and debt maturity profile of UHREIT correctly in my previous post. The fact that UHREIT has the option to exercise a 1-year extension option for a 50 million dollar loan is rather intriguing to me, although I do not fully understand the implications of this.

Overall, I do like how UHREIT's debt maturity is spaced out, although I dislike the absurdly high-interest rate. Hopefully, the management can become a bit less aggressive when it comes to asset acquisitions.

Closing Thoughts:

I am rather pleased with UHREIT's performance this financial year, given that it has performed in line with my expectations, coupled with management being able to properly recycle assets into higher-yielding, undervalued properties. I must also add that I am delighted by the proof provided by the Self-Storage properties that they can provide sufficient levels of cash flow in the absence of income support. However, I am saddened by the sky-high interest rates of UHREIT's debt profile. Should the option to extend the revolving credit facility be exercised, 2026 may prove to be a dangerous year for the REIT given the exceptionally high amount of debt maturing.

Think this article is something you'd want more of? Subscribe here using your email to get notified about my latest blog articles, I'd truly be grateful!

Disclaimer: Please take everything published within this blog with a pinch of salt. Nothing I say here should be misconstrued as any form of financial advice whatsoever. In fact, I am probably the absolute last person you should approach for any sort of advice. All self-computed figures are calculated to the best of my ability, but I cannot guarantee they are 100% accurate, and I am not liable for any investment decisions made based on my content.

Thank you for reading my blog, and I hope you have learnt something, no matter how seemingly minuscule, ciao!

Hi Mate, thanks for the detailed analysis as usual. Keep up the good blog postings for sharing ya. I just elected for opting to receive the recent distributions in units for this round @ US$0.485 per unit. But alas, the SVB banking crisis erupted. Hopefully, UHREIT does not dipped too low towards end of March 2023 else I will regret not buying from the open market. :p

ReplyDeleteHi Blade, really appreciate the encouragement. Hmm I think a lot of the negativity has been priced in, though we could see the price move further down if interest rates seriously go out of control. I'm sure your position will not go down too much though! I see at most a ~10% downside since fixed rate so high already.

Delete