Silicon Valley Bank Deposit Guarantee & Ramifications

I'm sure we've all recently seen the myriad of news article headlines highlighting the Silicon Valley Bank (SVB) Collapse that arisen from a bank run, with many people drawing comparison between it and the 2008 Lehman Brother's collapse. Additionally, if you're into Cryptocurrency, I'm sure you've realised the sharp drop of the crypto market recently, along with USDC (Celsius) losing its peg, which is rather natural given the fact that it has a large amount of collateral with SVB.

In this short article, I'm not here to explain what happened that led to the collapse, since many articles have already done a great job of that. Instead, I'm here to discuss the potential ramifications regarding the recent unprecedented move by the US Government that ensures all deposits in SVB would be guaranteed by Monday, which is today.

The reason why it's unprecedented is the fact that the guarantee includes deposits over $250,000 in US Dollars, which was the previous FDIC-insured threshold. The most likely reason behind the government's decision must have been due to the fact that over 97% of SVB's deposits were indeed over $250,000.

Now, you must be thinking: Where will the money come from to cover all this? I initially suspected that the government would simply redeem the government bonds owned by SVB immediately to prevent the paper losses of SVB from being further realised, but apparently, that's not the case. Your next thought must be that taxpayer dollars will be used to cover the losses. Socialise the costs and privatise the benefits, capitalism am I right? Well, that's not the case either. Instead, the FDIC will be charging a "special assessment fee", with the costs being borne by the banks that participate in the FDIC insurance system. Essentially, the cost will be spread out. If you're a shareholder or bondholder, then there's some bad news for you. You won't be covered by this guarantee, unfortunately, so pray that another bank is willing to merge with SVB.

As for whether there is a contagion risk materialising from this bank run - I'm not too sure. One would stand to reason that since most of SVB's clients were tech start-ups, the risk is limited. Not to mention, fractional reserve banking has gone a far way from $3 per $100 deposited. Now, banks are much less leveraged, albeit still vulnerable to bank runs.

Will this deposit guarantee prevent anything else from breaking? Only time will tell. The reported amount of unsecured deposits with SVB was approximately $151.6 USD Billion, with there being 4,236 FDIC banks in 2021. On average this would mean that each bank will most likely incur a maximum additional cost of $35.7 Million, taking into account the worst-case scenario of SVB's assets going to zero. Hence, I am of the opinion that damages will be minimal. However, the future is still filled with uncertainty. Since the deposits were not insured, banks may dispute the additional charge, given that they did not agree to such measures previously.

Not to mention, there have been some changes made by the US Government to prevent anything like this from happening ever again via the new Bank Term Funding Programme. Essentially, it allows financial institutions to take out a loan at face value against government-backed assets such as government bonds to meet deposit obligations. I'm not too sure about the paperwork regarding this programme, but it may make the banking system more resilient against bank runs in the future. However, one could also say that it incentivises negligence, allowing banks to reap the rewards of using deposited money to dump into bonds while not needing to take much responsibility.

Also, I just want to talk about the recent hype surrounding the possibility of the Fed stepping in to intervene with the SVB collapse. To put it simply, SVB collapsed due to rising interest rates initiated by the Federal Reserve, resulting in their current assets (Low yielding government bonds) depreciating in value, resulting in paper losses that were forced to be realised when a bank run started. Hence, many people have come to the conclusion that the Fed will slow down its interest rate hikes.

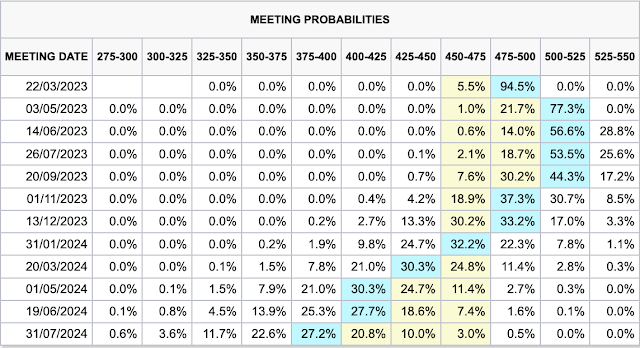

The interest rate hike probability that the markets have priced in has decreased from 50 basis points for the next meeting to 25 basis points as a result (If you're not familiar with this concept, you can visit one of my earlier posts regarding this topic here).

Personally, I think investors are being too sanguine. If Jerome Powell starts to falter in his fight against inflation now, he knows that he'll pay the price dearly in the future. I doubt that he will be willing to relinquish his fight at this most critical period when inflation has started to gain momentum once again. Not to mention the fact that SVB's after-effects are rather limited in my opinion.

Overall, I think we'll see a pretty bloody market at the next Fed meeting, and I'm betting my money on a 50 BPS rate hike. Of course, I could definitely be wrong, but this is simply how I see it so far. As interest rates increase, more and more vulnerabilities in our financial system will be revealed. Let's just hope nothing too crazy happens.

Author's Note: Sorry for the short article, since I know that's not my usual style. I was initially going to post a Bond article today, but I felt that posting this while the issue is still new and ongoing was rather important. Do feel free to share your thoughts below as well.

Think this article is something you'd want more of? Subscribe here using your email to get notified about my latest blog articles, I'd truly be grateful!

Disclaimer: Please take everything published within this blog with a pinch of salt. Nothing I say here should be misconstrued as any form of financial advice whatsoever. In fact, I am probably the absolute last person you should approach for any sort of advice. All self-computed figures are calculated to the best of my ability, but I cannot guarantee they are 100% accurate, and I am not liable for any investment decisions made based on my content.

Thank you for reading my blog, and I hope you have learnt something, no matter how seemingly minuscule, ciao!

Comments

Post a Comment