What You Need to Know About Bonds!

Lately, I've received some questions regarding finance from some close friends that got me thinking, with one of them revolving around bonds which you also may know as "Fixed Income". Prior to this, I'll be the first to admit that I always thought of bonds as rather boring; I had this preconceived notion that bonds were simply less volatile with less reward compared to equities, which I've come to realise isn't necessarily true. With this article, I hope to present the compiled information I've managed to gather about bonds in an easy-to-understand way!

Firstly, what exactly are bonds?

Bonds are a financial instrument that represents a loan made by a creditor to a debtor. Most bonds have a specified maturity, which is when the principal (The Original) amount gets repaid from the date when it was issued, typically paying out coupons (Interest Payments) semi-annually to bondholders.

For example, let's say you invest a total of $1000 into an average 3% Singapore Savings Bond which has a ten-year maturity. From the date of subscription, you will receive approximately $15 per year half till the end of your tenth year, which is when you will receive back your principal sum of $1000.

Notice how I say "average" and "subscription". The reason why I use "average" is that for certain bonds like the Singapore Savings Bond, coupon rates are not flat throughout the lifespan of the bond. Instead, it operates in a "ladder"-like structure.

Hence, although the average coupon yield is 3.15%, you receive more interest rates the longer you hold till maturity. As for why I used "subscription", well, I'll cover that in a later segment elaborating on the risks of bonds.

You also might find understanding the bond yield curve to be helpful. The yield curve is a graph of yield against maturity duration. Usually, the longer the maturity duration, the higher the average yield is supposed to be, assuming that the credit rating is the same. This reflects the additional risk the lender takes when lending out their funds for a longer period of time, since there is a higher probability that anything can go awry the longer the lending duration. Makes sense, right?

Sometimes it can become inverted though, which you can find out what it means by clicking here.

Now that you understand how bonds more or less work, I think it would be useful to learn about some of the more common bond types as well...

You might have heard of perpetual or convertible bonds, and are perhaps pondering the distinction between them.

To put it simply, perpetual bonds have no maturity date, and instead, pay coupons in "perpetuity". As long as you hold such a bond, you'll be earning coupons forever! Sounds great right? Well, be prepared to not receive back your principal payment, since, well, there's no maturity date... Of course, you may be able to sell bonds on the secondary market. Although you theoretically are getting coupon payments indefinitely, do take note that the real value of money diminishes over time. If you use the inflation rate and plug it into a geometric progression, you'll more or less be able to obtain the value of that bond.

Convertible bonds are a bit more complicated. They act like normal bonds but confer the right, not the obligation to the bondholder to convert the bond into equity (stocks) of the organisation by using the bond's face value at pre-specified dates. However, it is worth mentioning that the share price used for the conversion is typically higher than the market price.

Now, you may realise I haven't elaborated on why I highlighted "subscription", which is what I'll get into now.

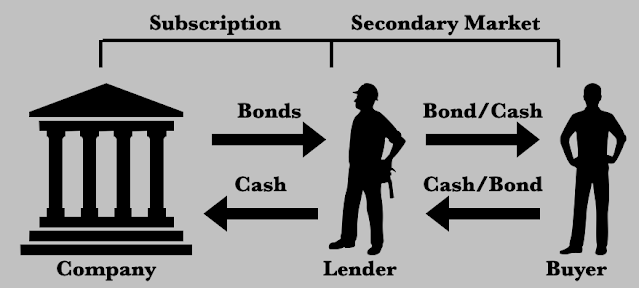

There are two main ways to get bonds (at least that I'm aware of).

Firstly, you subscribe to the initial bond issuing, which is when you purchase the bond (Subscribe) from the organisation directly at the stipulated terms.

The second way is to purchase bonds on the secondary market, which is where people like you and I buy and sell bonds to each other. Of course, not all bonds are available through this method, so it would be wise for you to do your due diligence. This comes with a few implications. For example, if someone subscribed to a 10-year bond offering in 2020, and decided to sell their bond in 2022, the bond's maturity would be eight years, which affects the total return over the bond's lifespan. There are also some risks you may need to take note of that comes with the secondary market, which I'll further expound on now.

You may be under the impression that your money is 100% guaranteed when it comes to bonds. But of course, we don't live in a perfect world. There is a myriad of risks one should take into consideration when investing in bonds.

Firstly, be wary of the interest rate set by the Central Banks. You see, the interest rates set by the central banks all around the world certainly influence the bond market. By increasing interest rates, the coupon yield of government bonds typically increases, which is often known as the risk-free rate. Hence, bond buyers may demand a higher yield on other bonds to reflect the increased opportunity cost of not buying those government bonds.

For example, a 5% yielding corporate bond seems more attractive when the risk-free rate is 1% as compared to 4%, doesn't it? This goes for some previously issued government bonds as well. Buyers aren't going to purchase a 2020 1% government bond over a 2022 4% government bond. If there is no option to redeem the principal amount at your whim and fancy like the Singapore Savings Bond, your only choice is to sell your bond at the secondary market if it's possible.

Let's compare two hypothetical bonds, assuming that they have the same credit rating. We have a $1000 face value bond maturing in one year at a 1% coupon rate. Hence, by maturity, the bondholder will receive a total of $1010 over the bond's lifetime. However, let's say that suddenly, bonds with a 2% coupon rate flood the market due to a rise in interest rates. Well, a one-year $1000 bond with a 2% coupon rate would result in a total of $1020 at the end of the bond's lifetime. Hence, to sell the initial 1% yielding bond, the price must drop from $1000 to $990. At $990, the bondholder will receive a total of $1010, which is equivalent to the $20 offered by the $1000 2% yielding bond. This is just one example of how rising interest rates may affect bonds. Of course, the opposite holds should interest rates drop.

Next, inflation affects bonds in the same way as well. Bonds are typically used for wealth preservation, and maybe a bit of wealth accumulation. You're not exactly preserving your wealth if inflation erodes the purchasing power of your funds, are you? Bondholders want to see real returns, which means that they expect coupon rates to exceed inflation. If inflation rises, then the real returns of bonds will be eroded. Hence, by the same aforementioned mechanism, bond prices will reduce to maintain their real return.

Source: Dreams Time

Issues of insolvency are a probable cause of concern for bondholders as well. When you purchase a bond, you typically expect to receive back your principal amount. However, the organisation can't pay you back if they have no cash to begin with. Hence, you might see your bond's value plummet to zero if the bond's organisation is unable to meet its debt obligations... This only serves to further highlight the importance of conducting your own research regarding the company's balance sheet health. You may have also seen credit ratings being mentioned. Credit rating is a "score" issued by credit rating agencies that indicate the corresponding company's ability to repay debts, with AAA typically being the highest. Of course, credit rating agencies are not infallible and are susceptible to a whole host of issues such as oversight and corruption. We mustn't take everything at face value!

Lastly, be wary of a bond's liquidity. If you overextend yourself or purchase bonds from a small company, you might face liquidity issues. Imagine that you have $10,000 in bonds locked up, and urgently need the cash for emergency expenses such as medical bills. Since you can't redeem them immediately, your only choice is the secondary market. If there are not many buyers, you could find yourself lowering the price drastically to receive your funds fast, so always make sure to not lock up more than what you would need! As a Singaporean, you could consider the Singapore Savings Bond, which allows you to redeem your principal within one month's notice.

To sum it up, bonds can gain or lose value in the secondary market, but losses won't be realised unless you sell them, or if the company is unable to pay back the money.

Of course, it isn't all doom and gloom for bonds. Bonds as a financial instrument have their own merits too!

In the (hopefully unlikely) case of insolvency, you'll receive priority as a bondholder over shareholders to receive the value of liquidated assets. Naturally, bondholders can rest well knowing that in case the company goes bust, they'll be one of the first ones to receive their fair share of the pie. In this sense, bonds are less risky as opposed to stocks from a bankruptcy standpoint.

Additionally, you can feel rest assured that you'll receive a steady stream of income from your bond coupons, as opposed to dividends which are subject to managerial decision-making. Not to mention, your principal is more or less protected. If bond prices go against your favour, simply hold on to your bond to receive back your principal, whereas if bond prices rise, you may use the opportunity to lock in some sweet capital gains!

After saying all this, how should you allocate your funds?

Of course, every investor has their risk tolerance, and it's absolutely paramount that you find out yours. Personally, as a young investor, I think an allocation of 0-15% bonds is okay. Since I have a high-risk tolerance, I would go for highly rated companies and not settle for the lower risk-free rate, such as the 6% Astrea 7 Class B Bonds currently available. As you age, your objective will slowly move from wealth accumulation to wealth preservation, and consequently, your percentage allocation of bonds should be increased to reflect this.

Disclaimer: Please take everything published within this blog with a pinch of salt. Nothing I say here should be misconstrued as any form of financial advice whatsoever. In fact, I am probably the absolute last person you should approach for any sort of advice. All self-computed figures are calculated to the best of my ability, but I cannot guarantee they are 100% accurate, and I am not liable for any investment decisions made based on my content.

Thank you for reading my blog, and I hope you have learnt something, no matter how seemingly minuscule, ciao!

Good one mate.....I also just realised that investing in simple boring govt bonds can lead to financial disaster like what happened to SVB in US over just a short time span.

ReplyDeleteHi Blade! Yep, SVB made a wrong bet regarding sustainable low interest rates... I am quite surprised that the uninsured deposits were bailed out. Not sure if we'll see more things break as interest rates rise...

DeleteMost likely more occurrences of business failures coming soon....the pace of rate hike too rapid and drastic by the Fed.....anyway, the last round US got itself out of stubborn inflation was through a recession.

DeleteTrue... too many businesses have gotten used to low interest rate. Not sure how Jerome Powell will balance between inflation and things breaking... I still think he will prioritise inflation though, since worst case scenario is government can bailout companies, but cannot directly control inflation (unless there are strict price controls... which seems unlikely.)

Delete