Fu Yu Corporation: Undervalued Dividend Gem?

Hello all, as promised, the main subject for today will be my (attempted) fundamental analysis of Fu Yu Corporation, a company that is mainly focused in the Industrials Manufacturing and Supply Chain Management business.

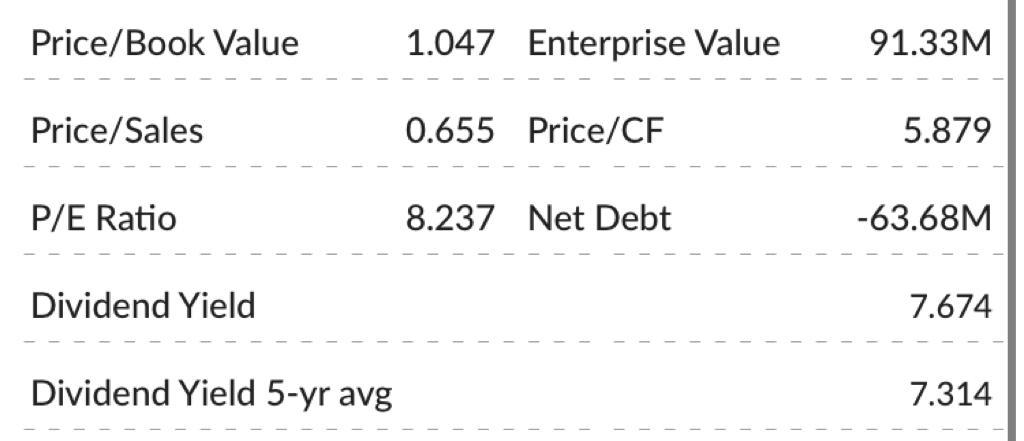

Firstly, let's take a look at some basic information readily available on the SGX app that caught my eye:

Dividend Yield 5-Yr Average of 7.3%? Net Debt of -63.68M while only having an Enterprise Value of 91.33M? P/E Ratio of 8.237?

Indeed, at first glance, such a company seems too good to be true. The relatively large cash holding compared to its EV means that its asset price is backed up by cold hard cash that can be used to redistribute earnings to shareholders or take advantage of the high interest rates currently available. No matter what, it certainly beats having large amounts of costly debt in the high interest rate environment we live in today. Additionally, a PE ratio of 8.237 is definitely on the lower side of stocks.

Okay, it seems promising on the surface. But anything can have a compelling value proposition depending on the way you spin it. Hence, we need to go deeper into the proverbial rabbit hole of Fu Yu’s financial statement history, compare it to its industry peers, and understand the management’s vision for the company’s future to ensure we are not blinded by greed in the face of the prospect of bountiful profits.

Financial “Deep”-Dive: Are the dividends sustainable? Or at the cost of the financial health and future growth prospects of the company?

I will be the first to admit that when you shove a company’s financial report in front of my face, I will probably understand less than 10% of the smorgasbord of financial jargon littered across its previously blank canvas. However, in spite of that, this blog aims to enable all of us to learn together :). Enough said, let's begin!

Immediately, there are some concerns I have when viewing these figures. Revenue has remained stagnant these past five years barring 2020 when a sharp drop occured most likely attributed to the COVID-19 pandemic. This could imply that the group has not been able to increase their market share and broaden their reach to new customers. Despite all this, seemingly against logic, the EPS has increased dramatically! How is this possible? If revenue has stagnated but profits have increased, it only means that cost has dropped. As I skim the Financial Year reports released by the company, I see more and more cost-cutting and process optimising strategies employed by the company. Although cutting costs are good, there is a threshold to how much you can actually cut, as opposed to revenue increase, which theoretically has a much higher limit than cost reduction. I would also like to implore you to ponder: If the group has so much cash, why are they not putting it to good use and driving up the company's revenue? To add on, based on the company's payout ratio, it seems that they were previously eating into their cash reserves just to please shareholders.

This brings me to my next short segment.

Fu Yu Management Team: Not necessarily looking out for minority shareholders

You may have noticed that the previous image had a caption that stated it excluded a special dividend issued in FY2021. That's because the Fu Yu Management Team issued a special dividend of 3.3 cents per share. That's right, that translates to a rough 10% return during that time period. This could indicate that the management, for a lack of better words, are clueless on what to even do with that fat stack of cash, and hence have no other idea but to return cash to shareholders. Essentially, they are admitting that they can't get a return on equity on that cash that they are confident would beat the returns shareholders could generate themselves. Sure, it could indeed be to "reward long term minority shareholders", but in today's selfish world, it's highly unlikely.

You may have noticed that the previous image had a caption that stated it excluded a special dividend issued in FY2021. That's because the Fu Yu Management Team issued a special dividend of 3.3 cents per share. That's right, that translates to a rough 10% return during that time period. This could indicate that the management, for a lack of better words, are clueless on what to even do with that fat stack of cash, and hence have no other idea but to return cash to shareholders. Essentially, they are admitting that they can't get a return on equity on that cash that they are confident would beat the returns shareholders could generate themselves. Sure, it could indeed be to "reward long term minority shareholders", but in today's selfish world, it's highly unlikely.

Furthermore, I have some concerns regarding the recent slew of position cessations. It seems that in recent times, there has been a high turnover for Fu Yu's management team, such as the CFO and changes made to independent directors and committee board members, which may indicate internal office politics and disagreement. As a consequence, there are now a significant portion of Fu Yu's management team that have little experience steering the company. Currently, it is too early for any financial results to be released, and hence not possible to see if such changes have any drastic material impact on the company's performance.

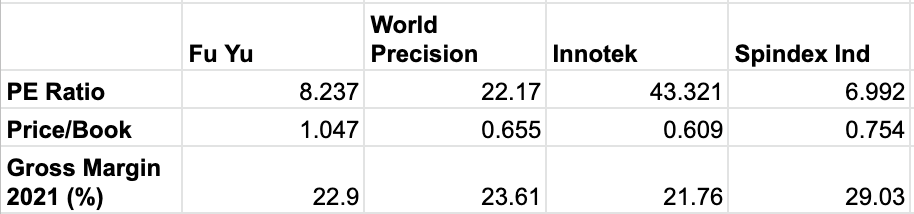

How does Fu Yu hold up against similar SGX companies?

The closest companies I could find that resembled Fu Yu's business operations were the following:

- Innotek (M14)

- Sarine Technologies (U77)

- World Precision Technology (B49)

Here is how Fu Yu compares to these companies in terms of financial metrics and valuations.

With a surface level comparison, it seems like Fu Yu's gross margins are in line with the industry average. Additionally, based on its ability to create free cash flow, it seems to be fairly valued as well. However, it's NAV is priced at a premium. Could this indicate that Fu Yu is able to generate a higher ROE from its assets? This seems in line with the conclusions that I have drawn earlier about Fu Yu specialising in cost cutting measures.

Is Fu Yu Corporation an undervalued stock right now?

After taking a quick look at the price chart provided by Yahoo, I have come to the conclusion that Fu Yu is trading at a fair price currently. Do not be mistaken by the sharp drop at Aug 26, as that coincides with Fu Yu's dividend distribution of 3.3 cents, resulting in a decrease in NAV and hence share price. Before this, it was going on a downtrend which I suspect could be attributed to the market pricing in Fu Yu's China segment performance deteriorating due to the reintroduction of stringent COVID-19 measures, coupled with it being the start of interest rate hikes which may lead to a future recession, dampening the company's earnings.

My conclusion is that Fu Yu is currently trading at a fair price, and that there is still some potential upside remaining at the price of $0.220 SGD per unit. Even if capital appreciation does not materialise, one can count on the fat dividends to lighten the mental load.

Eh, KOPL, you sound bearish at the start but now then tell me it's a decent buy? What gives?

Don't be mistaken. To put it simply, I am not confident of Fu Yu's GROWTH story, but I am fairly certain that it can continue to maintain its decent performance. To add further to the discussion, although Fu Yu's management team has not demonstrated perfect performance, I have a certain degree of confidence that they are at the very least, not using shareholders as cheap capital. Hence, as a prospective shareholder of Fu Yu, it is clear to me that this counter is a stable dividend play as opposed to a capital appreciation one.

Additionally, I would like to point out that bank analysts have issued target prices in the past, which, although mean absolutely nothing, indicate that financial institutions are indeed keeping an eye on the counter. I have also noticed that volume has recently been picking up. Is this a sign for things to come? Only time will tell.

To end off, I feel that Fu Yu is a decent buy at the current price, but not a stellar one. Personally, I think I will still wait a while before picking up this counter, as there are not much obvious catalysts to me at this point of time.

Think this article is something you'd want more of? Subscribe here using your email to get notified about my latest blog articles, I'd truly be grateful!

Disclaimer: Please take everything published within this blog with a pinch of salt. Nothing I say here should be misconstrued as any form of financial advice whatsoever. In fact, I am probably the absolute last person you should approach for any sort of advice.

Thank you for reading my blog, and I hope you have learnt something, no matter how seemingly miniscule. I would greatly appreciate it if you subscribe as such posts take a decent chunk of time to dish out, ciao!

Comments

Post a Comment