United Hampshire US REIT 2H DPU Drops 27.9%! Should You Be Concerned?

Introduction

It's no secret that the US Retail REIT comprises the majority of my portfolio. It could even be said that my portfolio IS UHREIT, and I can safely say that this will continue to be the case. If you're a regular reader of my blog, then you may recall in a previous post that I mentioned the fact that I would cut my UHREIT holdings if it reached 0.60 USD per unit. Obviously, that never materialised and instead of shooting up to 0.6, it has recently fallen to 0.44. Hence, in the spirit of doing things in an "opposite" sense, I believe this calls for a time of accumulation, foolish as it may initially seem.

The headline of UHREIT's 2H DPU drop of 27.9% is scary. I mean, it's understandable. Living on $60,000 per year of income is extremely different from living on $45,000 per year, so investors are naturally spooked by the seemingly dire results posted by the REIT. However, in this blog post, I'll hopefully be able to convince you that fundamentally, the REIT has actually posted rather average results, one could even say they're good going by certain yardsticks.

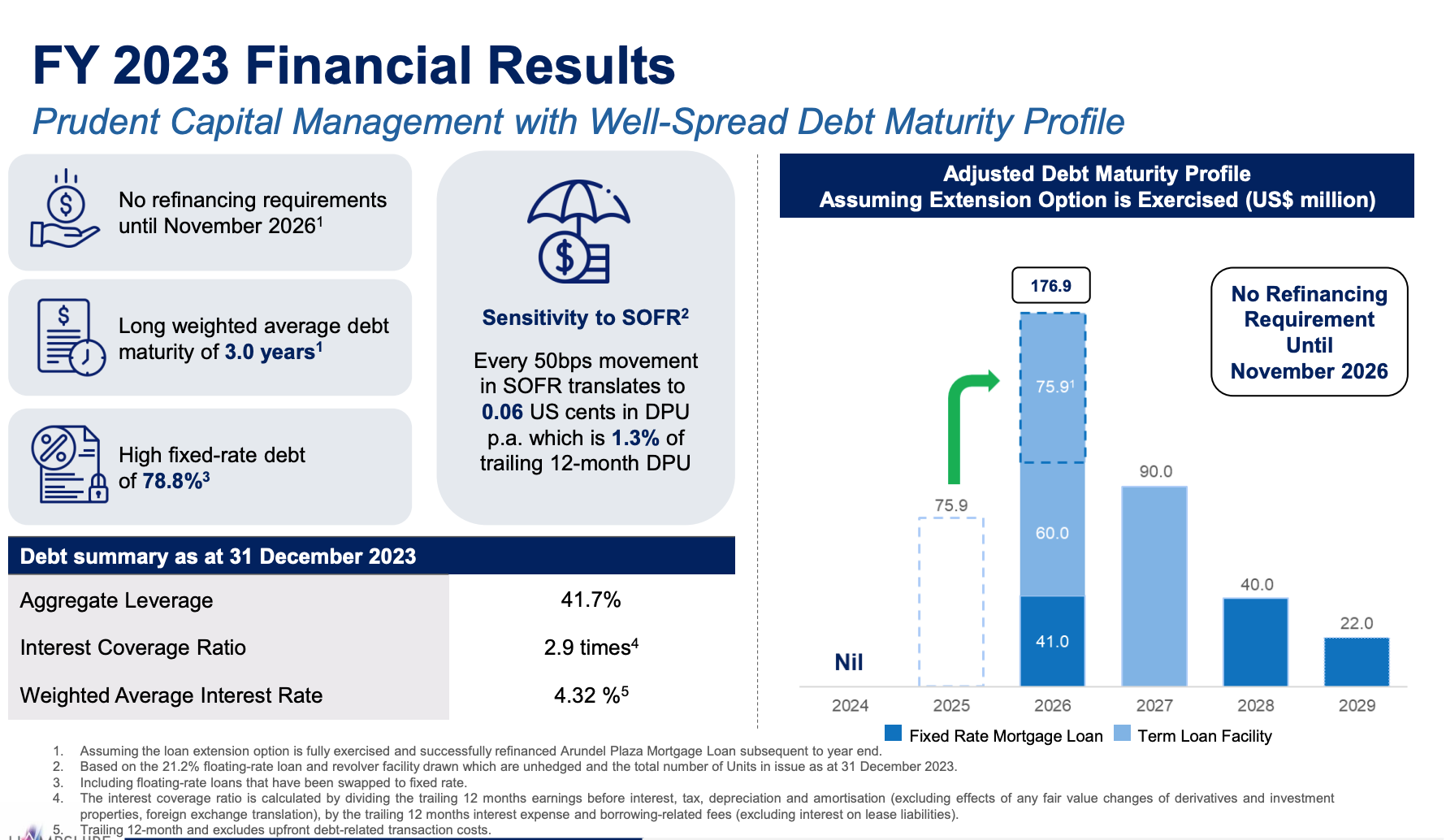

Review of Balance Sheet

One would most definitely be forgiven for categorising UHREIT in the same group as other SGX-Listed US REITs such as the likes of Keppel Pacific Oak US REIT (KORE), Prime US REIT, and even Manulife US REIT. I mean, UHREIT literally has the word "US" in the name. But it's important to differentiate the crème de la crème from the bourgeoisie. Do note however that with the state of US Commercial Real Estate nowadays, I use the term "crème de la crème" rather loosely, but we'll take what we can get.

With US CRE, the main concern within the context of Singapore REITs is the fact that many US CRE property valuations are on a free fall, reducing the REIT's overall portfolio valuation, which is the denominator in the formula for the gearing ratio. Naturally, this would mean that the overall leverage of US REITs may breach the 45% gearing limit imposed by the Monetary Authority of Singapore, alongside various bank loan covenants that may have been imposed on the REIT, leading to insolvency. In fact, certain REITs have already suffered this fate, and the results have been only what could be described as disastrous.

We can see that in a time when US office property valuations are free-falling, UHREIT's property valuations instead continue to climb, reducing overall leverage.

This tells us two things:

1. There's not too much to worry about regarding property valuations revising downwards due to higher interest rates. These increased property valuations are already conducted in an environment of high-interest rates, so ceteris parabus, as long as management doesn't decide to take on any more debt, we're most likely safe from any covenant or regulatory breach.

2. The asset class UHREIT specialises in is expected by financial institutions to do well in the coming years

I don't know about you, but I believe both are plus points for the REIT.

Review of FY2023 Performance

So Why Did DPU Drop So Much?

Overall Conclusion

Think this article is something you'd want more of? Subscribe here using your email to get notified about my latest blog articles, I'd truly be grateful!

I have no plans to initiate any additional positions in the stocks I have mentioned within the next 72 hours. All content published by me should not be construed as any sort of financial or investment advice and is simply for informational purposes. Although all research and figures are accurate and calculated to the best of my ability, I am not liable for any decisions made based on inaccurate information.

Hi Mate, excellent post as usual. Thanks for doing a review on UHREIT. Good thing that UHREIT has survived relatively well considering the dire financial strain faced by US commercial office REITs such as MUST, KORE and Prime. I also think that the market strangely seems to view UHREIT in the same light as the offices albeit very different nature of business.

ReplyDeleteAll the best for your new job!

Seems like UHREIT always gets a bad rep due to office REITs. However, this is exactly the best time to accumulate while the market doesn't realise the counter's true value!

DeleteThanks Blade for the well wishes! Currently learning lots!