Is DBS Bank A Long-Term "Must Buy?"

What do you first think of when I utter the name "DBS Bank"? Do you think of it as Singapore's Government-Backed Banking Institution? Do you think of your personal financial services provider? Perhaps, you may even think of the company's shares first, frequently touted as a solid pick for one's portfolio. In fact, DBS Bank is the highest-weighted constituent of the Straits Times Index, which is widely regarded as the Singapore Stock Market's benchmark index, weighing at a whopping 19.9% of the entire index. Chances are, you're a DBS client, and since DBS acquired POSB in 1998, POSB clients are DBS ones too.

This may be going off on a tangent, but I recently opened an account with DBS Bank. I have to admit that the entire process was not pleasant at all... For some reason, after acquiring POSB, my local banking branch was shut down despite catering to a rather large population. I'm not sure what's the rationale behind the decision, but I feel it wasn't a great one. Due to the branch closure, many elderly folk were redirected to another already-overworked bank branch, dramatically increasing customer inflow. The corollary of this is that no queue numbers could be given out after 12 pm, with wait times going up to 4-5 hours. This was all on a Tuesday by the way.

On the off-chance that you don't know what DBS does, then here's a summary from their website.

"DBS provides a full range of services in consumer, SME, and corporate banking. As a bank born and bred in Asia, DBS understands the intricacies of doing business in the region's most dynamic markets. DBS is committed to building lasting relationships with customers, as it banks the Asian way."

Doesn't say that much.

Okay, let's come back to the main topic at hand: Is DBS Bank a Long-Term "Must Buy?" It's very tricky to analyse banks in my opinion, especially big ones. Banks' services are seriously diverse, with many industry-specific financial metrics, which I will incorporate in today's analysis. Nevertheless, it's time for me to attempt to delve deep into the inner workings of Singapore's biggest bank, DBS!

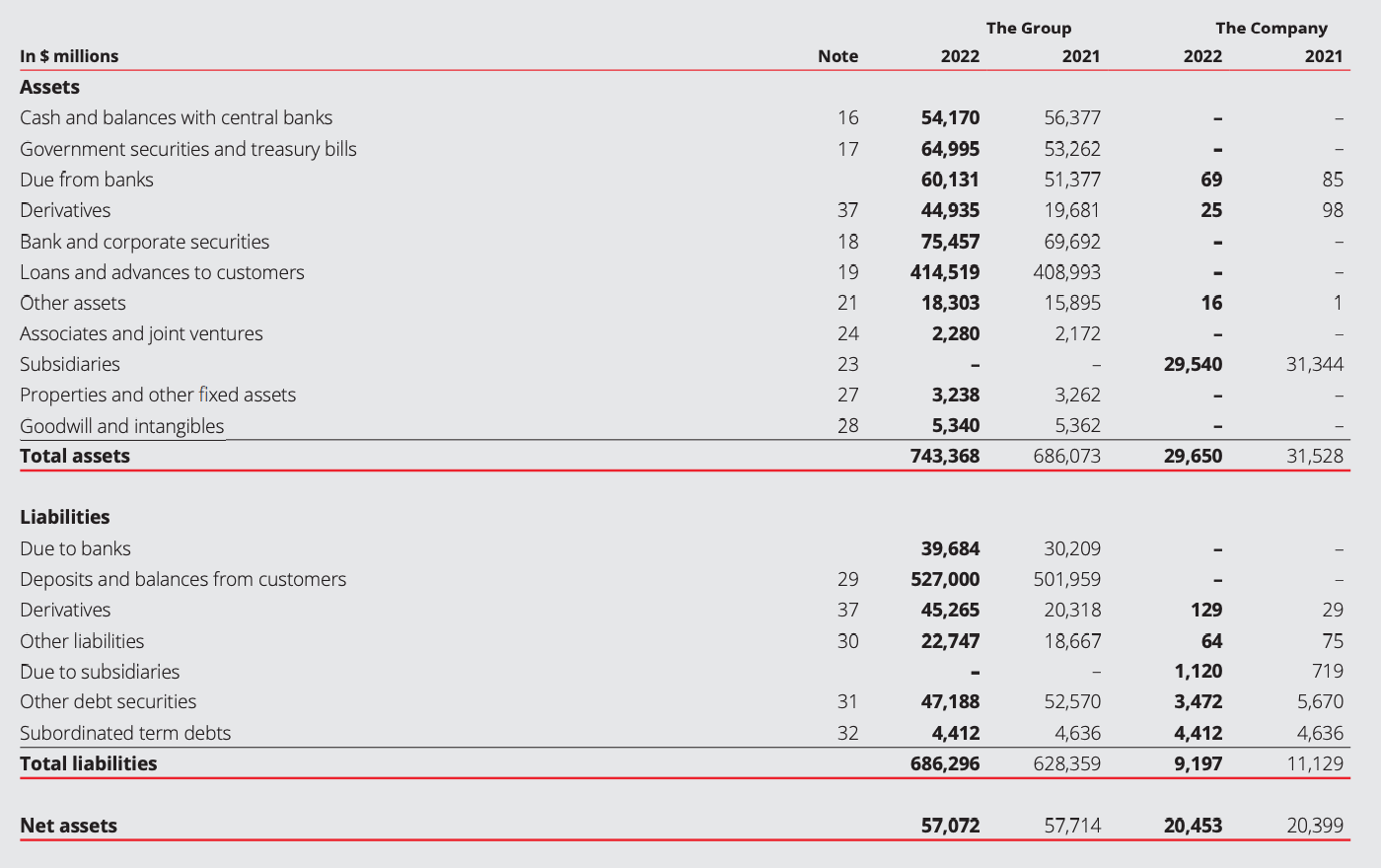

Like all companies, it's best to gain a deeper understanding of the company's balance sheet.

Unsurprisingly, DBS has had a great fiscal year due to the large increase in Interest income to the tune of 60%, attributed to the large interest rate hikes made by Central Banks in recent times, increasing net interest margin from 1.63% to 2.11%, vastly increasing profitability. Interestingly, net fee and commission income fell drastically, being offset slightly by the increase in net trading income. Overall, non-interest income fell marginally. According to DBS, the lower fee and commission income can be attributed to weaker market sentiment resulting in lower investment product sales, which does make sense. I don't see any structural weakening in DBS' core business model since it seems like most fluctuations are due to cyclical factors outside of the company's control.

On the other hand, I find the increase in DBS' employee benefits from $3.9 Billion to $4.4 Billion to be rather intriguing. I suspect that it could be due to the higher interest income experienced, resulting in higher bonuses for employees, which was confirmed when DBS confirmed a special monetary award presented to all staff for the fourth quarter. When I checked the historic employee benefits of DBS' annual reports, it seems that rising employee benefit is rather often, so it could perhaps also be attributed to high pay progression. Allowances for credit and other losses are almost x5, which I presume is due to the sharp increase in loan interest rates which would increase default risk. I would say allowances are still rather low and hence shows that DBS' consumer base is low-risk, although we should take this with a grain of salt due to allowances simply being an estimate.

In terms of comprehensive income, the translation differences for foreign operations could be attributed to the substantial depreciation of Japan, India, Vietnam, Taiwan, and Indonesia's currency against SGD, which resulted in the $950 million unrealised loss. I am not sure about the losses on cash flow hedges and debt instrument arrangements put in place by DBS, but one has to feel that they are rather severe for this year.

Source: DBS FY2022 Annual Report

Source: DBS FY2022 Annual ReportIn terms of DBS' balance sheet, there is not much to take note of besides an increase in consumer deposits.

Of course, DBS, being a bank, should be evaluated using metrics suited for banks...

I have compiled a few calculated metrics pertinent to this issue in the Google Sheet below:

We've all seen how much damage a bank run could potentially cause as illustrated by the recent Silicon Valley Bank collapse... So I thought certain financial metrics would be especially relevant.

Firstly, let's take a look at the CET1 ratio for DBS Bank, which is the highest out of the three local banks. If you're a layman just like me, then you probably have no idea what CET1 is. Well, it's short for Common Equity Tier 1 ratio, which is the ratio of "Tier 1" Capital compared to a Bank's risk-weighted assets. In short, it measures the bank's ability to withstand financial stress for whatever reason without affecting operations. To contextualise the banks' financials, the Monetary Authority of Singapore mandates that banks have a CET1 ratio of 6.5%, and a total Capital Adequacy Ratio of 10%, which is a metric that takes into account additional grades of capital. In short, the CET1 of all banks already surpasses the CAR requirement, which means that we can say that the banks will most likely not suffer any insolvency or liquidity issues.

We can see that DBS has the highest CET1 ratio of all the banks, coming in at 14.6%, which should mean that DBS is the most capable among the three local banks to withstand any shocks.

Typically, we can see how efficiently management is using their capital by reviewing their Return on Equity (ROE). A higher ROE would mean that more profits are being generated with the same amount of equity. DBS is leading the pack with the highest ROE of 14.17%, approximately 30% higher than OCBC and UOB. There may be a few reasons to explain this ROE...

Firstly, we can see the DBS has the highest CASA (Current Account Savings Account) ratio, which means that most of the bank's total deposits are in current and savings accounts. If you didn't know this already, then do keep in mind that banks don't exactly pay you much for holding your funds with them. When a higher proportion of their deposits are in such accounts, they incur fewer costs when lending out funds as opposed to things such as Fixed Deposits. Hence, this would naturally result in a higher return on equity.

We can also see that DBS has the lowest percentage of Non-Performing Loans (NPL) of 1.1% out of the three banks, which may be indicative of DBS' loan selection process being of a higher quality. A lower NPL means fewer loans are being defaulted on, which means less opportunity cost incurred for the bank, resulting in a higher ROE.

However, it is interesting to note that the Cost to Income ratio of DBS is actually the highest among the three banks, despite the highest ROE.

This could mean that DBS spends more on operating expenses such as rental leases, marketing, and employee benefits. Nevertheless, I would say that the much higher ROE supersedes the relatively higher cost-to-income ratio of DBS.

Can DBS continue to expand its business then?

"DBS as a bank has six core markets: Singapore, Indonesia, India, China, Hong Kong, and Taiwan. We are also present in other markets like Malaysia, Thailand, Vietnam, and Japan, where we recently received our securities trading licence, so we have a presence in practically every Asian country." - DBS Website

Many shareholders have vocally expressed their discontent with DBS's expansion in India, which is understandable, given that it's an emerging economy, and an investment in India may not necessarily pay off.

In today's Volatile, Uncertain, Complex, and Ambiguous (VUCA) world, rapid digitalisation has taken place, which could poise DBS for accelerated growth in their India division. I subscribe to the ideology that one should not go against progress, but be a part of it, and that applies to this case as well.

However, I would be a fool to ignore some of the obvious cons that accompany this expansion as well. Look no further than the precipitous drop in the Indian Rupee's value relative to the Singapore Dollar, and you'll understand what I mean. It's certainly not a pretty chart, and should it continue, we'll see the risk/reward ratio of DBS' venture into India increase.

However, there are some less obvious upsides to this as well. One could view the various foreign currencies as a hedge against the Singapore Dollar, stabilising DBS' yearly profits should our reputation as Asia's Financial Hub start to fade.

Not to mention, according to Singapore Business Review, 5 in 10 Singaporeans have invested in the stock market, with 18% of Singaporeans indicating their interest in 2021. Yes, the fact that you are reading this probably means that investing is no longer a mystical, unknown phenomenon. Could we see more fees being earned by DBS from commissions and brokerage charges?

Now, it's best to get a better idea of how the management has performed so that we can be assured that our funds are in safe hands.

Currently, Piyush Gupta has been serving as the Chief Executive Officer of DBS since 2009.

"DBS is a leading financial services group in Asia, headquartered in Singapore. Recognised for its global leadership, DBS has been named "World’s Best Bank" by several global publications like Euromoney and Global Finance. The bank is at the forefront of leveraging digital technology to shape the future of banking, and was also named “World’s Best Digital Bank” by Euromoney. In addition, in 2019, DBS was listed among the top ten most transformative organisations of the decade by Harvard Business Review.

Prior to joining DBS, Piyush had a 27 year career at Citigroup, where his last position was Chief Executive Officer for South East Asia, Australia and New Zealand.

Piyush is currently the Chairman of the Board of Trustees of Singapore Management University, Vice-Chairman of the Institute of International Finance, Washington, and Vice-Chairman of the World Business Council for Sustainable Development (WBCSD) Executive Committee. In addition, he is a member of Singapore’s Advisory Council on the Ethical Use of AI and Data, and Bretton Woods Committee - Advisory Council. He sits on the boards of Singapore’s National Research Foundation, and the Singapore’s Council for Board Diversity. Piyush is a term trustee of the Singapore Indian Development Association (SINDA). Previously, he has been a member of the Singapore Emerging Stronger Taskforce, aimed at defining Singapore’s future in a post-Covid world, the UN Secretary General’s Task Force on Digital Financing of the Sustainable Development Goals, and the McKinsey Advisory Council.

Piyush has a Bachelor of Arts (Honours) Degree in Economics from St. Stephen's College, Delhi University, India and a Post Graduate Diploma in Management from IIM, Ahmedabad.

Piyush was awarded the Public Service Star by the President of Singapore for his meritorious services to the nation in 2020. He is a recipient of the 2023 Pravasi Bharatiya Samman Award, the highest honour conferred by the Indian Government on the country’s diaspora.

Piyush was named one of the world’s top 100 best-performing chief executives in Harvard Business Review - 2019 edition of "The CEO 100". He was named Global Indian of the Year by the Economic Times in 2021, Singapore Business Awards' Outstanding Chief Executive of the Year in 2016, and Singapore Business Leader of the Year by CNBC in 2014."

Certainly an extremely extensive CV. With a brief glance, it is evident that he is an extremely experienced individual familiar with technology. Not to mention the fact that DBS has been flourishing under his leadership. Sadly, he was instated as CEO in 2009, which was just after the Global Financial Crisis, which means that I am unable to accurately assess his performance when it came to risk management...

Back in 2008, I was merely 4 years old, so it's not all too surprising that I wasn't able to recall the absolute devastation caused by the GFC. Hence, I wanted to see how was DBS impacted during the GFC so as to see how the management fared during such dire times. Shockingly, I would say that the bank did pretty well. Yes, EPS was substantially impacted, but it was certainly not the end. In fact, it could be seen as being merely set back by 5 years to 2005 levels of earnings. Besides, the bank still did maintain its asset value despite the GFC. Overall, I would say that the bank's performance was commendable amidst the uncertain economic conditions.

Now, is the management of DBS aligned with shareholders' interests?

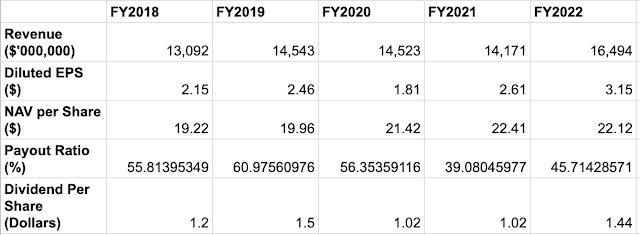

From the chart above, we can see that DBS has rarely made dividend cuts, only doing so notably in the years FY2009, 2010, and 2020. Personally, I feel that DBS has made a valiant effort in being committed to maintaining their dividend, only doing so when it was prudent or mandatory to do so. In retrospect, I would say that it is understandable for DBS to cut their dividends in 2009 and 2010, given the fact that the global economy was still reeling from the effects of the GFC, hence, conserving cash would have been a wise move. Moreover, the 2020 dividend cut was literally mandated by the Monetary Authority of Singapore (MAS).

It may also be worth noting that the bank did do a rights issue back in 2009 so as to conserve capital to guard against any unknown GFC ramifications. Overall, shareholders are not significantly/needlessly diluted and have been receiving stable and rising dividends historically.

Okay, so Piyush Gupta has been a rather competent CEO, but he's already 63, is there anyone to take his place?

Thankfully, I was able to gather some information regarding this subject matter from a 2019 Euromoney Interview. In the interview, he elaborated on his plans regarding his successor as the bank's CEO, having around 5 successors in mind. Furthermore, he stated that he prefers generalists, being able to handle all matters related to the bank with at least some degree of competency.

So far, he has name-dropped three potential candidates: Tan Su Shan, Shee Tse Koon, and Han Kwee Juan. From what I can see, they all seem to have rather clean records and are competent in what they do. Hence, I believe that when the time comes, Piyush Gupta would be able to properly groom his selected candidate into a competent CEO.

Personally, I am betting on either Tan Su Shan or Han Kwee Juan succeeding. Piyush Gupta has commonly expressed his interest in transforming DBS into a revolutionary bank that incorporates heavy digitalisation into its services. Hence, it is no surprise that DBS has ventured into providing Cryptocurrency-related services, and has even been described as a "tech company" by Piyush himself. Naturally, I would assume that he would want someone that has the necessary vision to help DBS continue to innovate and tap into potential markets, which is exactly what Head of Strategy & Planning Han Kwee Juan is doing. However, Han Kwee Juan has only joined the group recently, and if Piyush values experience and company loyalty, then Tan Su Shan would most likely be his pick, given that she has the most experience at the company of the three, and can be seen as a 'generalist' given that she is the head of Institutional Banking.

Overall, I am relatively confident that DBS will be in good hands for the foreseeable future, given that it has no shortage of talents.

Now, it's time to review DBS Bank's historical performance, so as to see whether it can be seen as a long-term investment!

It's very evident that by all accounts, revenue, EPS, NAV and dividends have all steadily increased throughout the years, with DBS constantly making sustainable dividends that hover along the 50% payout ratio mark. It seems like EPS and Revenue were slightly affected during the COVID-19 pandemic though, which is reasonable. Moreover, DBS has always been known as a reliable, stable bank that is widely considered to be "Too big to fail", which is further backed up by the fact that 29% of DBS is owned by Temasek Holdings, the government's investing arm that would never allow for such a huge bank to fail.

Is DBS cheap at current prices?

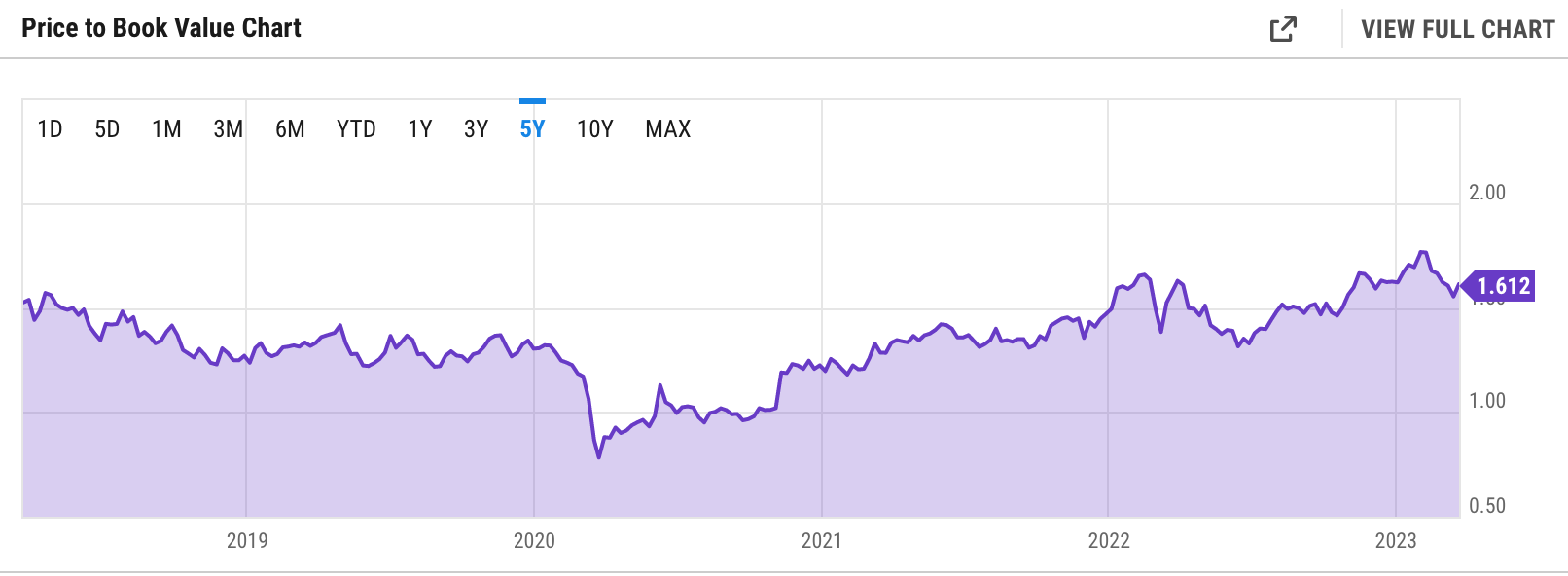

According to YCharts, the average 5 Year Price to Book ratio for DBS is 1.332, which is a far cry from the current price of 1.514 price to book. The reason why I use Price to Book as opposed to PE is due to the fact that banks' assets are typically static as opposed to a bank's earnings which may be affected by cyclical macroeconomic factors. Is it fair to be paying such a high book value for DBS? Personally, I find that hard to justify when OCBC and UOB are trading at 1 and 1.1 Price to Book value respectively. I think 1.3 is justified, given that DBS' ROE is approximately 30% higher than its peers, but this is just too much.

DBS may also simply be trading at an extraordinary premium due to the recent interest rate hikes which have elevated NIM. However, as rates continue to rise, NPL may continue to increase, while Loan Volume may decrease. Moreover, an economic recession may occur soon as the high-interest rates snuff out businesses, resulting in higher unemployment and further exacerbating the aforementioned problems. As more things start to break from the interest rate hikes, we could see interest rate cuts sooner than I expected, although I think that's slightly less probable. Overall, I stand firm on the position that Banks' earnings will plateau and normalise shortly, which would make the current premium placed on DBS unsustainable.

That being said, I still do believe DBS is a great long-term hold. There's nothing else like investing in Singapore's financial future by channeling our funds into bank stocks. With seemingly competent management, it is probable that DBS will continue to enjoy sustained, high growth. Just give DBS some time and I'm confident that your yield on cost will be extremely high in the long term. I would be more than willing to revisit DBS at 1.3 PB, and if it goes near 1, then it most definitely would be a "Must Buy", assuming the overall fundamentals remain intact.

Author's Note: I have to admit that DBS' core business model and industry is something I find extremely challenging to analyse since the company is so large and complex. There are a lot of accounting terms that I had to research, and which I admit I may not have fully got a grasp on.

Additionally, this will be my final post before going on hiatus due to currently serving my NS in Tekong, which I elaborated on in my latest previous post.

Think this article is something you'd want more of? Subscribe here using your email to get notified about my latest blog articles, I'd truly be grateful!

The author is currently not vested in any equities discussed in the article.

Thank you for reading my blog, and I hope you have learnt something, no matter how seemingly minuscule, ciao!

Excellent post and analysis on DBS- you must have spent days preparing the materials and research. Thanks a lot PL Mate for sharing this post! Used to hold DBS during COVID time but have since took profit and sold off to buy REITs. If DBS drop below S$30 per share again, I will definitely go in to buy again.

ReplyDeleteHow’s your first week at Tekong? Trust all’s well.

Hey Blade! So sorry for the late reply to your kind comment! I foresee a gradual drop in favour for Bank stocks in a two year time frame. So far everything is manageable! Can cope with the training!

Delete