Daiwa House Logistics Trust - Japanese Logistics REIT Trading At Discounted Valuations?

Introduction

Daiwa House Logistics Trust Logo (Source: DHLT Website)

Daiwa House Logistics Trust, hereby abbreviated as "DHLT", is sponsored by Daiwa House Industry, and is an industrials and logistics SGX-Listed REIT with 16 modern logistics properties located in Japan, which translates to 444,728 square meters of Net Lettable Area (NLA) and a total appraised value of 87,531 million JPY. Do take note that the REIT's investment mandate does permit the company to acquire industrial assets outside of Japan but located within the ASEAN region.

DHLT's Balance Sheet Health

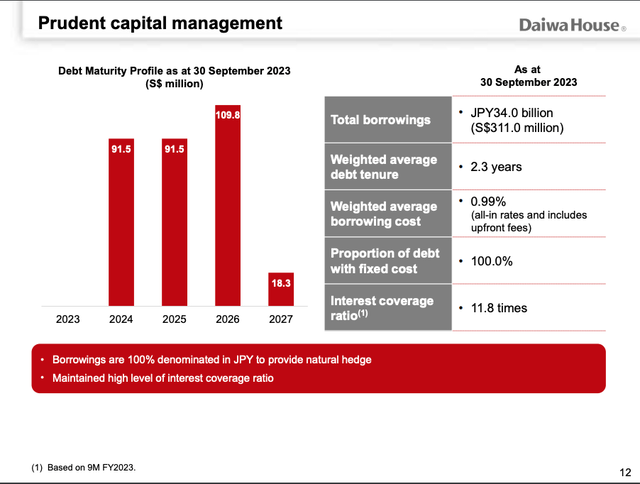

A simple glance at DHLT's balance sheet easily lets one surmise that the company has a healthy financial position, at a safe Gearing Ratio of 36.2% and an extremely high ICR of 11.8x. In terms of borrowing, there is a high margin of safety when you consider the fact that the Monetary Authority of Singapore (MAS) only imposes a gearing limit of 50% when ICR is a minimum of 2.5x and a limit of 45% when the minimum ICR has been breached. Suffice to say, the REIT won't be forced to liquidate assets any time soon, even if the Bank of Japan (BoJ) decides to hike rates, the fact that 100% of loans are fixed will still offer some leeway for the REIT's financial position.

DHLT's Debt Maturity Profile Q3 FY2023 (Source: DHLT Q3FY23 Investor Presentation)

In terms of the debt maturity timeline, I must confess that the REIT's maturity ladder does not appeal to me. Roughly 30% of total debt expires each year from 2024 to 2026, which typically increases refinancing risk, but I understand where the management is coming from.

Historically, Japan has had an extremely weak economy due to low domestic demand potentially arising from the conservative nature of the country's population. To spur economic growth, the Bank of Japan (BoJ) has maintained negative interest rates, although this is poised to end by 2024 January. Nevertheless, it can be rather safely assumed that interest rates will remain low, and since this has been the case for quite some time, I presume that the management does not foresee any refinancing or higher interest rate risk. Hence, any additional lengthening of fixed loan terms would simply be seen as unnecessary finance costs incurred.

The maturity ladder isn't exactly what I'd find ideal, but the decision is definitely understandable, despite the potential risks. Overall, I'm neutral on this part of the balance sheet.

DHLT's Portfolio Performance

Due to DHLT's short tenure as a listed entity, we don't have enough data to compare DHLT's historical financial performance. Nevertheless, we can use certain metrics to obtain a rough gauge of the REIT's asset quality and performance.

In terms of JPY, DHLT's performance improved YoY in Revenue and NPI, while Distributable Income improved in terms of SGD despite the weakening of the JPY throughout the year against SGD. This can be mainly attributed to the currency hedges set in place by the management. Additionally, portfolio occupancy increased from 98.6% to a remarkable 100%.

DHLT's Financial Performance Cont.

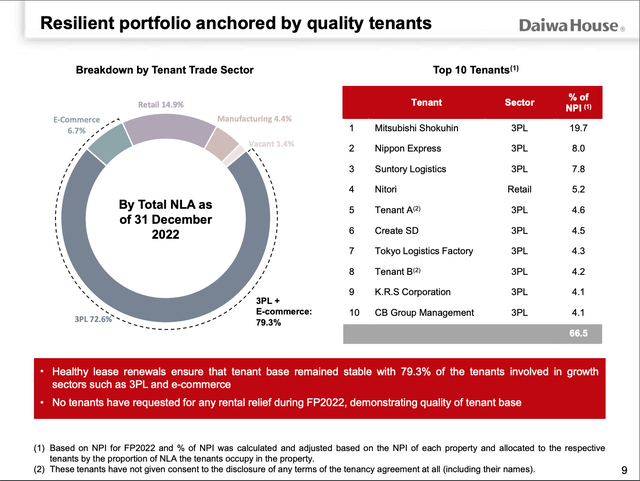

WALE is an impressive 6.3 years, ensuring the stability of DLHT's cash flows for years to come, whereas rental reversion for FY2022 was 3%. The high Q3 FY2023 occupancy of 100% was above average when compared to Tokyo's average of 91.1% in the same period according to CBRE. The above-average occupancy rate, coupled with the fact that rental reversions for Tokyo Logistics properties more or less fluctuated between a band of positive and negative 1% is a testament to the quality and desirability of DHLT's properties. This does make sense when you're considering the fact that DHLT's portfolio consists of multiple Built-to-Suit(BtS) properties with a sole tenant, giving the REIT higher negotiation power and WALE given that close substitutes are probably not abundant in the overall market with the specifications required by the tenant.

DHLT FY22 Top 10 Tenant Contribution (DHLT FY22 Investor Presentation)

That being said, I do have an issue with DHLT's top ten tenant contributions. I understand that the company reassures investors by stating that 79.3% of tenants are involved in growth sectors, but that simply means there could potentially be room for negotiations regarding higher rents, not whether the tenants would do well during times of economic crisis. As a corollary of this, a REIT must always try to diversify its tenant base as much as possible, although I concede that this is most likely due to the REIT's small size and high concentration of BtS properties. Although, understandably, such a situation may arise, it is still nevertheless a drawback that cannot be ignored.

DHLT's Qualitative Aspects

Daiwa House Industry, being DHLT's sponsor, should be scrutinised heavily, since there's not much of a track record for DHLT itself. If you didn't know, Daiwa House Industry is one behemoth of a real estate construction and development company, being listed on the Tokyo Stock Exchange (TSE) with a Market Capitalisation of 2.82 Trillion JPY, or over 25 billion SGD. A massive company like that can certainly aid its' REITs in terms of securing better financing terms, or perhaps even provide financing during times of credit crunch. The sponsor's management would most likely have the experience and expertise necessary to guide the REIT in trying times as well, positioning it for ample growth.

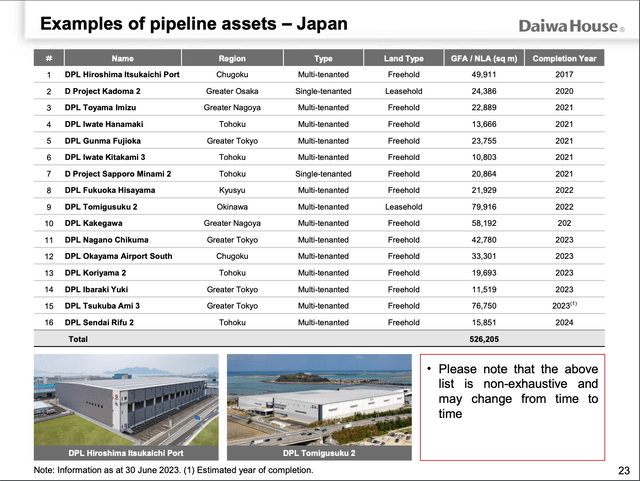

To add on, a reputable, strong sponsor can also inject high-quality assets into its REIT's portfolio.

DHLT 2H FY23 Investor Presentation

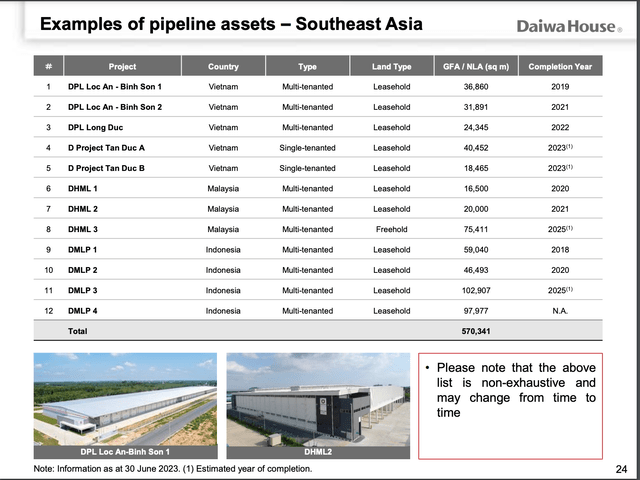

DHLT's ROFR Asset Examples (DHLT 2H FY23 Investor Presentation)

A non-exhaustive list of potential assets acquired by DHLT from the sponsor via the ROFR pipeline already exceeds the current NLA of the REIT, showing ample room for future growth. The numerous freehold, multi-tenanted assets are also a welcome sight to see, given that they can help the REIT diversify away from the current extremely high Top Ten Tenant Contribution.

DHLT's Management and Fees should also be assessed to ensure maximising shareholder value is the main objective of the firm.

The management fee for DHLT is rather simple, with the management fee consisting of 10% of the annual distributable income paired with a performance fee of 25% of the increase in DPU multiplied by the weighted average number of units issued compared to the financial year preceding it, ensuring management does not simply lay on their laurels and stagnate the growth of the REIT. The fee can be elected to be received by the management purely in cash, units, or a mixture of the two. Such a fee structure incentivises DPU growth and thus aligns with shareholder interest since it takes into account potential dilution and discourages dilutive acquisitions.

DHLT's Total Outstanding Units FY22 vs 2H FY23

There has been minimal unit dilution incurred from management fees in the short term.

Investment Thesis for DHLT

Ever since the United States Federal Reserve hiked interest rates by approximately 5%, REIT prices have languished due to two main factors:

1. REITs, mainly perceived as dividend instruments, are a closer substitute to bonds than growth or conventional stocks since there is a mandate to distribute at least 90% of taxable income. Hence, investors demand a premium to the initial dividend yield, resulting in prices dropping.

2. REITs are typically highly leveraged entities, with debt being an integral part of their capital structure. REITs are disproportionately affected given their propensity to take on higher proportions of debt compared to other firms. Hence, a rise in interest cost reduces the distributable income rather significantly, assuming the entity's loans are not fixed.

From the perspective of a Singaporean investor, it may seem initially that DHLT is only affected by reason 1 given the already low cost of debt, and hence would not benefit substantially relative to other REITs when interest rates eventually fall. However, one may neglect a certain key factor when assessing DHLT;

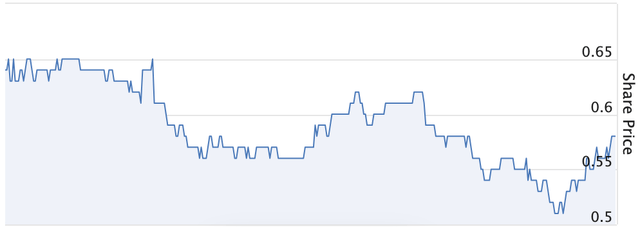

DHLT's Share Price Falling in Tandem with JPY/SGD (Source: Stockopedia)

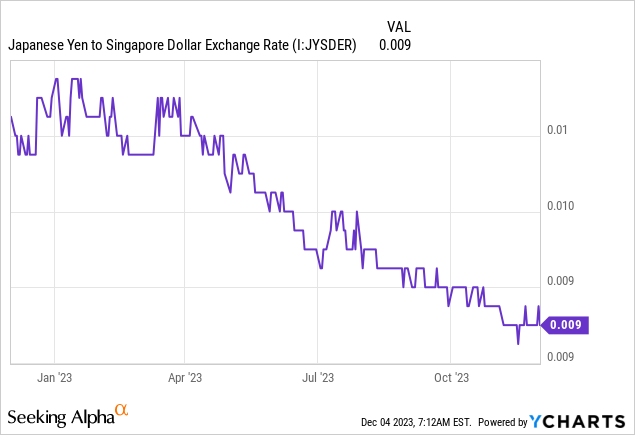

DHLT's share price has fallen for a third reason, which would be the depreciation of JPY against SGD due to Singapore's interest rates catching up with The United States' whereas the BoJ has remained firm on its negative interest rate stance for the time being. Due to the concept of hot money, foreign investors would naturally incur an outflow of JPY into other currencies like SGD, temporarily depreciating the JPY. Given that the BoJ aims to increase Japan's interest rate next year, and with analysts concurring that a rate reversal will occur in the US, we may see the JPY strengthening against the SGD sometime within the next year, which may pull DHLT's share price in tandem.

Furthermore, there has been a growth in demand for logistic properties all across the board.

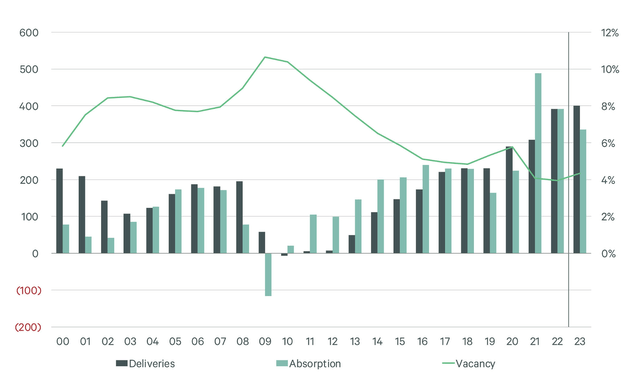

Growth in Logistic Space Demand Illustrated by Lower Vacancy (Source: CBRE)

With the global E-Commerce business being projected to grow at an approximately 10% CAGR for the next five years, it's no wonder why the logistics space industry is experiencing a growth in demand. E-commerce businesses need logistic properties to consolidate and store their products while they're in transit or being sold, and REITs like DHLT will continue to benefit from the market trend.

BtS properties may also act as a moat for the REIT, given the fact that such buildings are built with extremely tailored specifications in mind that are required by the tenant for their operations. This increases the negotiation power the REIT has when it comes to rental reversions since tenants are more or less locked in.

Key Risks & Headwinds for DHLT

Logic dictates that if interest rates can come down, they can also go up. Should we see a change in government stance regarding Japan's interest rates, the all-in financing cost of DHLT's debt may balloon, leaving shareholders stranded with little to no distributable income, especially when the majority of the REIT's debts require refinancing within the next 3 years. Likewise, countries outside of Japan may continue to maintain and even further hike their interest rates, further depreciating the JPY, and dragging DHLT's price along with it.

It was only about a month ago when the BoJ adjusted its Yield Curve Control (YCC) policy, allowing for 10-year yields to cap out from 0.5% to a new 1.0% limit, paving the way for possibly higher interest rates. Although Japan indeed maintains a target of 2% annual inflation, it is currently suffering from disproportionately high cost-push inflation, as opposed to inflation brought about by higher aggregate demand. Should the BoJ turn hawkish, the REIT may refinance into much higher rates in the short term, especially due to its weak debt maturity profile.

BtS properties are not all sunshine and rainbows however, should a tenant leave or be unable to meet its payment obligations, there could arise a long downtime period when the REIT is unable to collect any income from its properties, exacerbated by the fact it must still maintain the highly troublesome and specific vacant property. Not to mention the fact that such highly specific properties might struggle to find new tenants due to incompatibility between the property's specifications and the tenant's requirements.

Lastly, DHLT is a new REIT. There is insufficient data or history we can draw from to conclude certain aspects about the REIT. Hence, there is inherently more risk incurred.

Valuation of DHLT

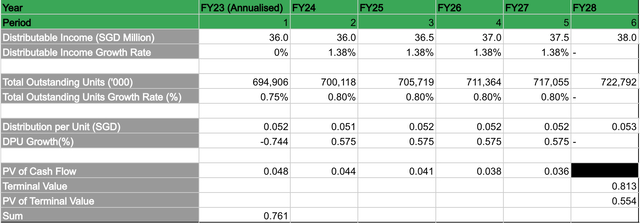

To properly assess the true intrinsic value of DHLT, I found a Gordon Growth Model(GGM) to be the most suitable method, since REITs are mandated to distribute 90% of taxable income, the dividend payout ratio should remain more or less the same throughout the forecasted period.

GGM of DHLT

Here are the following assumptions and their corresponding rationale:

1a. To calculate the Capital Asset Pricing Model (CAPM) value, the 10Y return of the Straits Times Index (STI) of 9.00% CAGR with dividends reinvested, was used since it is widely accepted as the SGX benchmark index.

1b. The 10Y Singapore Treasury Yield of 2.935% was used as the risk-free rate, coupled with a beta of 0.83.

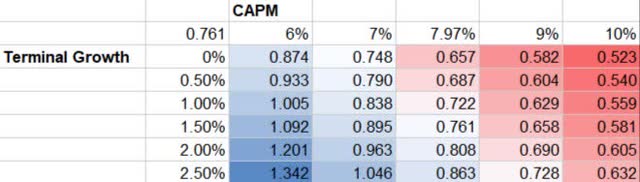

DHLT GGM Sensitivity Analysis

1c. A terminal growth rate of 1.5% was decided as an arbitrary number, but more or less tracks Japan's recent annual GDP growth. Hence, to account for potential variance, I have varied terminal growth by substituting Japan's GDP CAGRs with slight alterations. CAPM was varied as well should STI CAGR be different than expected.

2. FY2023's Total Distributable Income was annualised based on 9M FY23's performance, to be able to use up-to-date figures for the analysis.

3. The Foreign Exchange Rate for JPY/SGD was presumed to be constant since any further depreciation would be offset by currency hedges, combined with the fact that even if hedges expired, it would most likely be in an era of relatively higher interest rates for Japan.

4. The growth in Total Outstanding Units was obtained by assuming that management took approximately all management fees in units, increasing to 0.8% from the second year to take into account performance fees, and that no equity fund raising takes place.

5. Distributable Income was projected to grow 0% for the first year to factor in any possible recession or interest rates remaining higher, whereas the figure of 1.38% was derived by taking the proportion of the variance between 9M FY23 and 9M FY22's Revenue translated into Distributable Income. By assuming the forecasted growth in revenue is equal to FY22 rental reversion (3%), the figure of 1.38% was obtained.

Overall, the base case intrinsic value derived from the GGM is approximately 76.1 Singapore Cents, with a valuation of 132.4 Singapore Cents and 52.3 Singapore Cents being the bull and bear cases respectively. I must confess though that assumptions 3 and 5 would be in my opinion, the weakest links. However, I've tried to make the overall calculation rather conservative by the nature of its assumptions.

When DHLT first IPOed in 2021 just before the interest rate hikes, it was x4.9 oversubscribed at a valuation of Price to Book 1.05 and Dividend Yield at 6.5%.

Currently trading at a P/B ratio of 0.80 and a dividend yield of 8.85%, I believe it's a fairly decent interest rate cut play. The yield spread between the 10Y Singapore Treasury Bond and DHLT has remained roughly the same, signifying that the ticker is trading at fair valuations. Should interest rates come down, that may prove to be uplifting news for the JPY, increasing the REIT's DPU and NAV in SGD terms.

Overall Conclusion

All in all, DHLT has shown to be a promising up-and-coming Singapore REIT, with great quality assets in its current portfolio and with many more to potentially come from its huge sponsor. I don't foresee much risk in its balance sheet, with future cash flows most likely being stable. Hence, I believe there is an opportunity being presented here with asymmetrical risk-reward.

Dividend Investors, who wish to get paid during a market downturn while waiting for prices to recover will most definitely appreciate the high single-digit yield the REIT currently offers.

When I buy stocks, I highly appreciate a margin of safety of at least 20% (60.9 cents), which roughly coincides with the current price of 0.59 SGD per unit.

Initiate BUY for DHLT at 60.9 Singapore Cents per unit, and a hold rating for DHLT at 76.1 Singapore Cents per unit.

Author's Note: I initially wanted to try my hand at writing for Seeking Alpha, but this article was rejected due to it not being a US exchange stock :(, which is why you see some stylistic changes in terms of writing and formatting!

Think this article is something you'd want more of? Subscribe here using your email to get notified about my latest blog articles, I'd truly be grateful!

The author is currently not vested in any equities discussed in the article.

Thank you for reading my blog, and I hope you have learnt something, no matter how seemingly minuscule, ciao!

Hi PL, good post and thanks for sharing this. Like the way you deep dive and analyse the financials. Will you be buying any DHLT?

ReplyDeleteHi Blade! Glad to see you drop by, with the recent REITs run up, I think I will stay on the sidelines a bit for now. DHLT is currently trading at 0.61 SGD per unit which coincides with my buy price, but gut feeling says that it is still too premature to see a sustained REIT rally. 0.61 is quite a distance from 0.565 when I first wrote the article. If price comes down just slightly then I will initiate a minor position in it. I believe that the asset class is quite good and that the yield spread between it and the blue chip logistics/industrial REITs is a tad too large, but track record is wise I would like to see a bit more. To be honest, I'm actually looking at accumulating the banks should prices drop even further.

DeleteQuite detail writeup. Interesting way to use GGM for valuation

ReplyDeleteThank you for the kind comment and thanks for reading Vince! Appreciate the content you put out very much!

DeleteWelcome, let's all learn together

Delete